Buying a travel insurance policy is a topic that requires a lot of personal research. Every situation is unique and we all have different needs. On the same hand, every company and every policy offers different coverage’s. It’s a little complex. Therefore, you need to read the fine print. Make a decision based on your needs.

With all of the uncertainty in travel these days, it’s not a bad idea to purchase travel insurance. If you have flown recently you have probably had your flight delayed or canceled. Having travel insurance will cover extra expenses you could incur due to travel delays. It will also reimburse your cruise if you miss it because of these delays.

Cruise lines will not refund your cruise fare if you have a medical emergency if you are in the penalty phase. It’s possible to move your cruise date with a small fee but they won’t refund your money.

Cruise line insurance may look like a less expensive option but it doesn’t always cover extras like airline cancellations, etc.

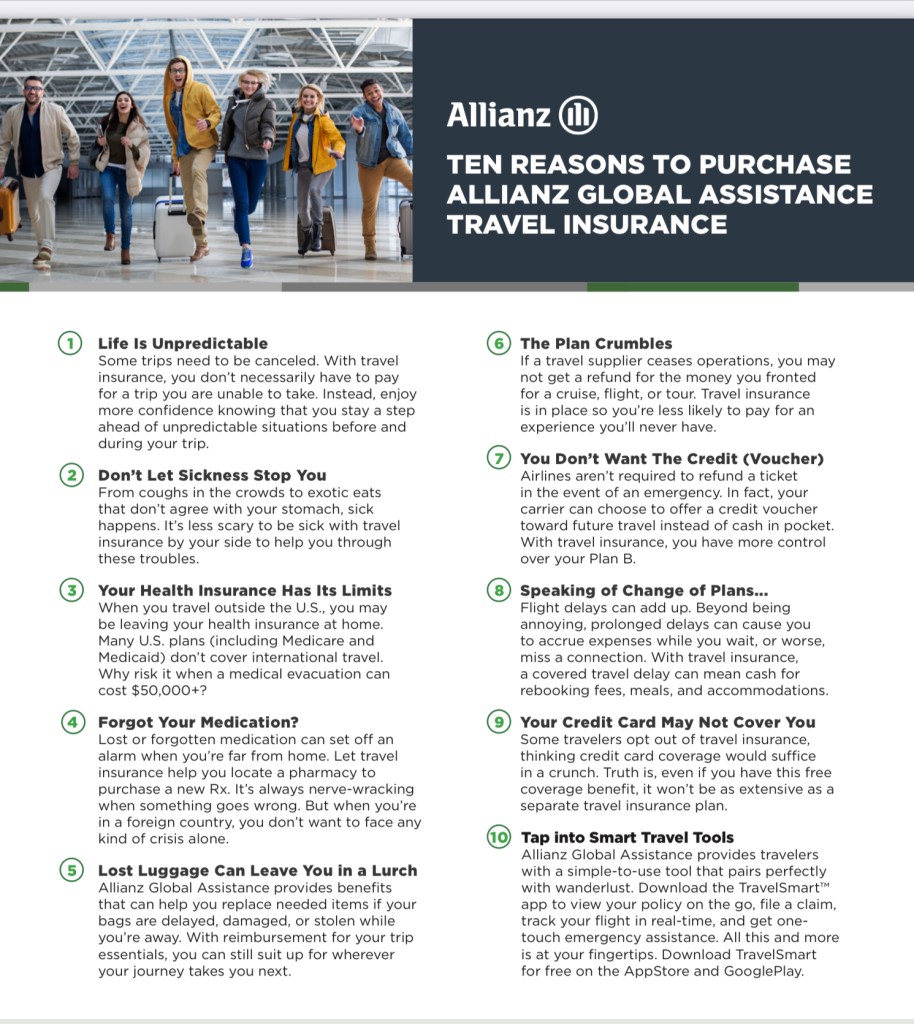

My company offers policies from Allianz Insurance, which has a good reputation in the industry. I give my clients quotes but encourage them to check around before they purchase their policy from me. Just google “travel insurance” and read through the different available options. Again, you need to research the coverage options before you buy.

When requesting a quote be sure to include extra expenses such as airfare, hotels, shuttles. Include extra traveling dates. Consider this if you are flying or traveling to your cruise a few days pre-cruise or post-cruise.

Speaking of lost items, travel insurance covers lost or damaged items. I left my cell phone on the seat of a cab in Puerto Rico last year. With proper documentation, Allianz immediately settled my claim and paid us $500.

As we’ve gotten older, I always purchase a policy now. Besides travel delays and lost items, we have medical concerns that makes it a good investment.

IF you need to make a travel insurance claim, ensure you keep all documentation. This serves as proof. Hold onto emails and receipts. You will have to pay upfront for most things. For example, if you lose your luggage and need toiletries and clothes or need to visit the ships medical center. Keep notes and every receipt. We even had to supply a death certificate for a claim!

There are different deadlines for purchasing different types of coverage. Buy your policy when you book. Alternatively, purchase it by the final cruise line payment. This timing will typically ensure you have coverage for pre-existing medical conditions. Again, read the fine print before purchasing.

Canceling your cruise may be covered for a variety of reasons. The reasons are outlined on the policy. There is an option of purchasing a “cancel for any reason” policy. These policies are typically more expensive.

The insurance company will not reimburse you for any payments made to you by the airline and cruise line.

ALWAYS READ ALL OF THE FINE PRINT BEFORE PURCHASING.

Again, research, ask questions, and compare your options.

As a travel agent, I may not always be able to assist with your claims. This is only possible if you purchase insurance from my company. I can give suggestions and provide information but I won’t have access to the company you use.

Leave a comment